If you’re just starting to think about buying a home, you’ll have a zillion questions. Here’s a huge one.

“How much house can I afford?”

Before you get too deep into looking at individual homes online, you need to get a ballpark idea of how much money you can borrow so you can figure out if you can buy a home and what kind of home you could buy.

- Figure out your price range.

- See if there are any homes in your price range that you would like to buy.

Right now, let’s stick with, “How Much House Can I Afford?”

How Much House Can I Afford

If you’re just starting to explore buying a home, then you probably don’t want to go to all the trouble of finding a loan officer you trust just to figure out your price range.

That’s where online mortgage calculators are great. You can get a good idea of your ballpark price range in less than half an hour.

Online mortgage affordability calculators give you quick and dirty estimates of how much home you can afford so you can start zeroing in on neighborhoods and homes you can afford to buy.

My current favorite home affordability calculators are at;

Realtor.com – How much house can I afford?

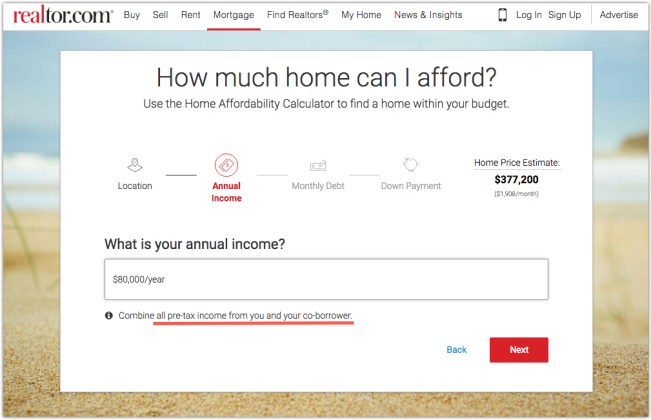

To start, let’s go to Realtor.com’s “How Much Home Can I Afford?” calculator.

I like this one because it’s easy to understand and at the end they breakdown the monthly mortgage payment;

- Total Monthly Payment (PITI)

- Mortgage principal and interest,

- Property taxes,

- Homeowners insurance, and

- Mortgage insurance.

Realtor.com Homepage

Location

Income

Current Debt Payments

Money You Have for a Down Payment

Realtor.com Estimate

I really like that they don’t just tell you the most expensive home you can afford. They show you 3 different prices- a Conservative, a Moderate and an Aggressive home price.

If you go up to the Aggressive home price, you’re very likely going to end up being house poor and financially fragile. There’s no room for the unexpected personal or employment problem. Everything has to go just right.

Their Moderate house price would give the buyer in this example a debt-to-income ratio of 36% (assuming they calculated their debts correctly).

So the total amount of debts they would pay each month – including the mortgage as outlined – would equal 35% of their gross income. That means 65% of their income would be available for all other household expenses like food, utilities, car repairs, medical bills, federal and state taxes, etc.

In the olden days, 36% was sort of the most a lender would lend and there were very few foreclosures back then.

Nowadays, lenders are happy to take on a lot more risk. That means a lot more foreclosures but overall the banks make more money because they’re lending a lot more money to the people who they don’t foreclose on. Some lenders will let you go up to a 50% debt-to-income ratio!

Unfortunately, all of that extra money chasing homes has led to much higher home prices. But for the lenders, higher home prices just mean bigger loans and more profit.

Try not to play their game and try not to get in over your head when buying your home.

Making Changes

Click “Edit” to make any changes and to play around with the numbers.

Add Condo Fees

If you’re planning to buy a condo, you might want to play around with the condo fees to see how much higher condo fees reduce the price you can afford to pay.

Breakdown of Estimated Monthly Mortgage Payment

Your monthly mortgage payment has more to it than just paying back the principal and interest. You also have to pay;

- Property taxes. They vary a ton from place to place.

- Homeowners insurance. This is how your lender makes sure you have insurance on the place. It would be bad for the lender (as well as for you) if the place burned down and you didn’t have insurance.

- Mortgage Insurance. It’s expensive. If you put less than 20% down as a down payment, your lender makes YOU pay for mortgage insurance every month. It doesn’t protect you. It protects your lender. Homeowners insurance protects you which also protects your lender. Mortgage insurance, on the other hand, just protects your lender. But your lender won’t lend you money with less than 20% down unless you pay it each money.

You can avoid paying mortgage insurance entirely if you put 20% down as your down payment.

This monthly mortgage payment is known as the PITI – Principal, Interest, Taxes & Insurance.

Smartasset.com – How much house can I afford?

Next, open up a new tab and go to Smartasset.com’s “How much house can I afford” page. You’ll see that their estimates are probably a lot different than Realtor.com’s.

Location

Most mortgage calculators ask the same basic questions but you’ll see a few differences.

Marital Status

Smartasset.com asks separately for your income and your spouse’s income.

Pre-Tax Income – Yours

Pre-Tax Income – Your Spouse’s

Down Payment

Monthly Debt Payments

Results

Closing Costs are huge! Something I love about the Smartasset.com calculator is it doesn’t hide the estimated closing costs. Many buyers are shocked by the size of their closing costs. It’s a BIG out-of-pocket expense. It shouldn’t be hidden.

In addition to having cash for your down payment, you need to have the cash for your closing costs. You may be able to get the seller to pay some of your closing costs but the seller would likely want you to pay a higher price for the house in that case.

AND closing costs are EXTREMELY variable.

- Mortgage Fees. Most mortgages have large origination fees you pay at closing. (Other mortgages have lower origination fees but they charge you more per month.) In addition, your lender will require that you buy a title insurance policy to protect the LENDER from any future title problems.

- State Transfer Taxes. Some states tax home sales and the tax can be huge! Those taxes are called “transfer taxes” or “transaction taxes.” Most states, however, don’t have transfer taxes.

- Other Closing Costs. Several smaller fees.

Condo Fees

Condo Fees. If you’re planning on buying a condo you need to take the condo fees into account.

Credit Score. Smartasset.com doesn’t ask for your credit score, their calculator just assumes your credit score is excellent. If you know your credit score is not “excellent,” you should change it in the left-hand column.

Nerdwallet.com – How much house can I afford?

Now, to get a third opinion open a new tab and go to Nerdwallet.com’s “How much house can I afford” page.

It’s hard to find this Nerdwallet calculator from their homepage so just click the link above to go directly to it.

Like the others, Nerdwallet.com asks for Location, Income, and Debt.

Income and Debt

Credit Score

Nerdwallet.com specifically asks for your credit score instead of just assuming it’s excellent. That makes for more accurate estimates, especially if your credit score is not excellent.

Down Payment AND Closing Costs

Nerdwallet.com takes a “cash-to-close” angle. Instead just assuming you have enough money to cover the closing costs and leaving it out of the calculator, Nerdwaller.com’s calculator asks how much money you have to cover both the down payment AND the closing costs.

So you put in the cash you’ve saved up to buy a home and put it below where I put the red box. From that amount, they first take out the closing costs and what’s left is available to be your down payment. Knowing your down payment, they can estimate how much money you would have to borrow at each home price.

How the Cash is Split

Click on the tab to see how the closing costs and down payment are split out of that cash.

Details

Hover over the slider to get the full details.

It’s great that they show you the estimated income you’d have to spend on living expenses (and savings) for the future AFTER you buy.

Can you cover all the rest of your bills and living expenses (expected and unexpected), and still save for the future after you buy?

Best “How Much Home Can You Afford” Calculators

You’ll probably want to bookmark those web pages.

Spend a half-hour online knocking around home affordability calculators and you’ll get a good feel for,

- How incredibly variable these online affordability calculators are.

- All the extra costs you have to pay each month when you own a home.

- All the extra closing costs you have to pay at closing when you buy a home.

You should also have a very good idea of how much house you can afford.

Next Steps

- If buying a home looks doable, you should now start looking for a mortgage loan officer you trust.

- Let me hear in the comments about your favorite “How Much House Can I Afford” calculators.

# # #

One Response to Top 3 Mortgage Calculators – “How Much House Can I Afford?”

[…] you don’t already know your home price range, check out this post on how to find out […]

Comments are closed.